AI Killed Meta VR

I want to start with something very simple: I’m a big fan of VR.

Not “fan” as in I watched a keynote and tweeted about it. Fan as in I’ve owned almost every major headset generation—from the early clunky models, to Oculus, all the way to the latest Meta headsets. I’ve used them. I’ve tested them. I’ve tried to make them part of my workflow. And I’ve invested in the space.

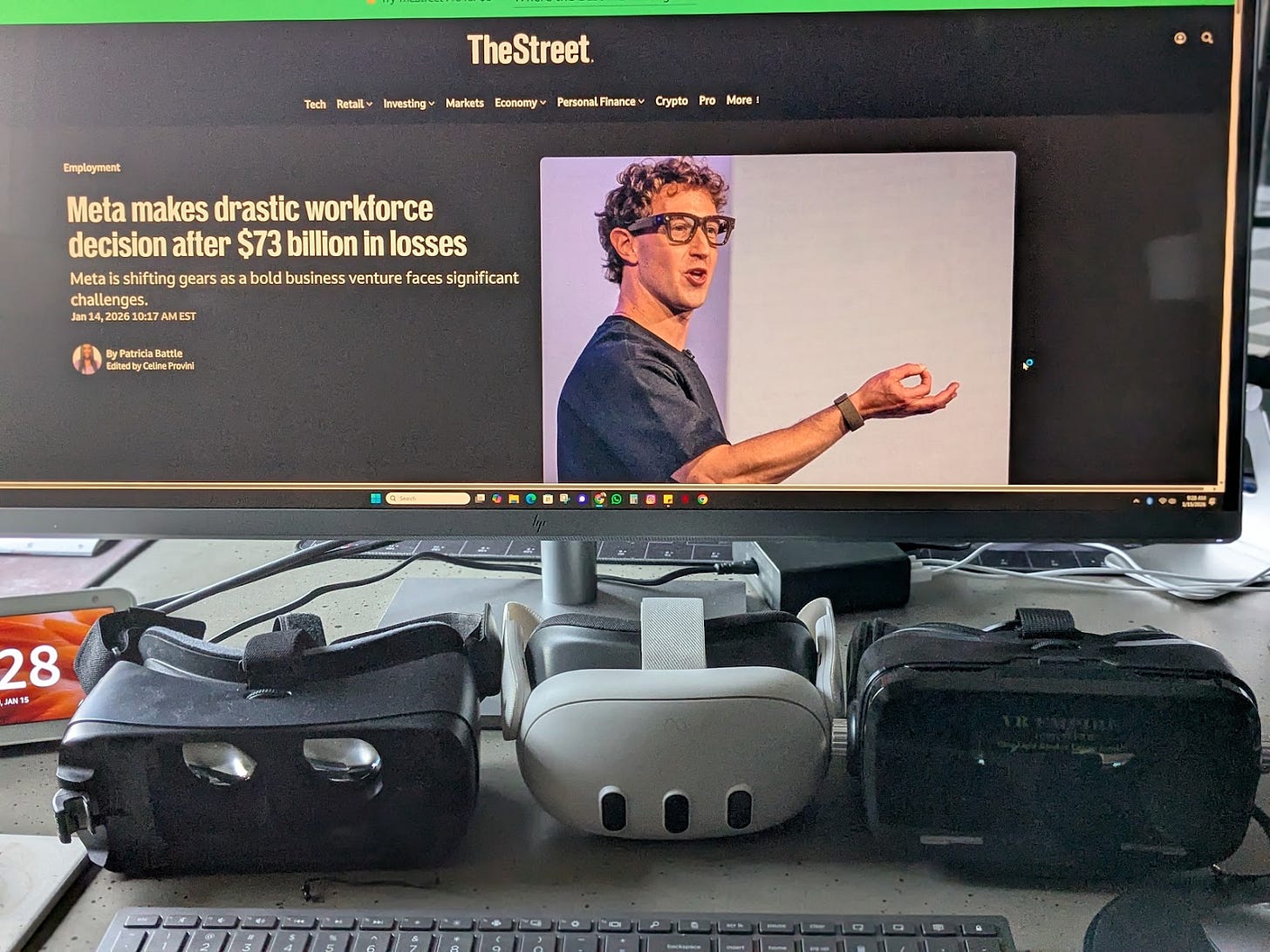

Just look at my desk to see how much I lived in the VR world!

Through a fund I co-founded, I was an early investor in Mira Reality, a company that was eventually acquired by Apple. So when I talk about VR, this isn’t theory. It’s lived experience—product, capital, and time.

I also remember 2022 vividly. Crypto was peaking, money was free, and everyone suddenly had a VR + crypto idea. People seriously pitched me on selling NFTs inside VR worlds tied to “virtual real estate.” Even back then, that should have been a warning sign. When the use cases drift that far from real human behavior, you’re no longer building a product—you’re building hype around a failing model.

The First Cracks

One of the earliest signals that VR was in trouble showed up closer to home.

Mira Reality started with a consumer vision, but adoption was hard. Really hard. What did work was enterprise—especially warehouses. Put a headset on a worker, tell them where to go, what to pick, what to pack. Clear ROI. Clear value.

But there’s a pattern here. When a consumer product quietly pivots to enterprise, it usually means consumer adoption is broken.

It reminded me immediately of the Segway. Remember when everyone said it would change transportation? It didn’t. It found a niche in enterprise and tourism and quietly faded from the “this changes everything” conversation. When I saw VR heading in that same direction, I started to worry.

Apple buying Mira made sense. They wanted the technology. They wanted the option value. Apple is very good at buying capability, not hype. But even that didn’t change the underlying adoption problem.

The Data Got Ugly

Fast forward to now.

Meta has poured more than $73 billion into Reality Labs since 2021. And recently, they made major layoffs and budget cuts in that division. Companies don’t do that when they believe the payoff is just one more cycle away.

The data explains why.

In Q3 2025, fewer than one million VR headsets were sold worldwide—a 21% year-over-year decline. That’s not slow growth. That’s a contraction.

If VR were going to break out, Meta would have seen it first. They controlled roughly 80% of global VR market share in 2024 and 2025. If the market was there, Meta owned it.

And it was still shrinking. That kind of data forces brutal honesty.

Even Apple Couldn’t Save It

Some people argued Meta’s problem was pricing. Too cheap. Too mass-market. Apple would fix that with a premium product.

Except it didn’t. Apple Vision Pro launched near $3,000. Meta headsets started around $300—a nearly 90% price difference. Neither strategy worked.

Apple reportedly sold only around 45,000 units in Q4 2025. For Apple, that’s noise. When the best mass-market consumer company and the best premium consumer company both fail to ignite adoption, the problem isn’t execution. It’s behavior.

People just don’t want to live inside headsets.

Why VR Never Crossed the Chasm

Here’s the part that rarely gets said out loud. Even as someone who owns multiple headsets, VR is a pain.

You have to keep them charged. You strap a heavy device to your face. After 30 minutes, your forehead feels it. It’s isolating. It’s awkward. You can’t really work in it. You can’t do meetings effectively. You’re not wearing it for hours a day.

VR is great for novelty. Travel simulations. Games. “Wow” moments.

But consumer platforms live or die by frequency, not fascination. And VR never earned daily behavior.

AR Is Working — And That Matters

Here’s the important distinction. While VR stalled, AR (Augmented Reality) glasses are quietly working.

Meta’s Ray-Bans. XREAL. Prescription and non-prescription. I’ve met multiple people in just the last couple of months who bought them—and actually use them.

Why? Because glasses are natural. Socially acceptable. Lightweight. Always on.

And AR doesn’t work without AI.

If I’m walking down the street and looking at a restaurant, I want reviews instantly. Context. Recommendations. That’s not VR. That’s AI layered onto the real world.

Meta sees this. The future isn’t a headset that replaces reality. It’s glasses that enhance it. And the better the AI, the better the experience. Which brings us to the real reason VR died at Meta.

AI Was the Tipping Point

Big companies don’t leave markets just because they lose money.

I spent years around Microsoft, and we had a saying: we don’t get it right until the third attempt and after spending tens of billions of dollars. Meta and Apple absolutely would have kept investing in VR if they believed consumer adoption would eventually click.

What changed everything was AI. AI isn’t just another bet. It’s existential.

Gemini is surging. Copilot is embedding itself into enterprise workflows. OpenAI and Perplexity are moving fast. And Meta is not top-three—or even top-five—in AI right now.

Meta also isn’t the kind of company that licenses its brain. They’re not going to hand control of intelligence to someone else’s model.

That leaves one option: go all in.

AI competes directly with VR for capital, talent, compute, and executive focus. And unlike VR, AI already has pull from consumers and enterprises. Once that reality set in, VR stopped being defensible.

The Bottom Line (And What Meta Does Next)

VR didn’t fail because Meta lacked conviction. They had conviction. They had patience. And they had more capital than almost any company on the planet.

What VR lacked was consumer gravity.

AI has it immediately. So this wasn’t a philosophical decision. It was a resource allocation decision. Meta’s next moves are actually very clear.

First, they will pour even more billions of dollars into AI—models, infrastructure, talent, and distribution. Meta wants its own LLM to win, deeply embedded across every surface they control.

Second, AR glasses become the new hardware endpoint—but AI is the product, not the glasses. The glasses are just the delivery mechanism.

Third—and this matters more than people realize—Meta is under pressure inside its core businesses.

People are already using AI to enhance their Instagram, WhatsApp, and Facebook content. But they’re doing it outside of Meta. They generate videos, captions, images, and edits in other LLMs—then come back to Meta just to post.

That’s a massive problem. Facebook doesn’t win by being a distribution endpoint. Facebook wins by keeping users inside the ecosystem for multiple interactions per day.

That flywheel breaks if intelligence lives somewhere else. Which is why acquisition is absolutely on the table.

Meta has never been shy about what looked like “overpaying” early. They bought Instagram for $1.5 billion when people said it was reckless. They bought WhatsApp for $19 billion and were mocked for it.

In hindsight, those were some of the best consumer internet acquisitions ever made.

If Meta believes a company like Perplexity—or another leading LLM—can accelerate their position fast enough, they will not hesitate. Speed matters. Catching up matters. Owning the intelligence layer matters.

The real story isn’t that Meta abandoned VR. It’s that AI forced the company to admit that it needs its own top three LLM to own the interface, intelligence and drive daily repeat usage. VR didn’t support that future. AI does. And once that became obvious, the rest of the decision was inevitable.